Save Up To $1200 in Federal Tax Credits with Plantation Shutters

You can earn up to 30% of the purchase price of Coverly Hybrid Wood Shutters as a federal tax credit, capped at an annual limit of $1,200.

Save Up To $1200 in Federal Tax Credits with Plantation Shutters

You can earn up to 30% of the purchase price of Coverly Hybrid Wood Shutters as a federal tax credit, capped at an annual limit of $1,200.

Save Energy, Save Money

Save Energy, Save Money

Save Energy, Save Money

Save Energy, Save Money

Save Energy, Save Money

Save Energy, Save Money

Save Energy, Save Money

Save Energy, Save Money

Shutters With Savings

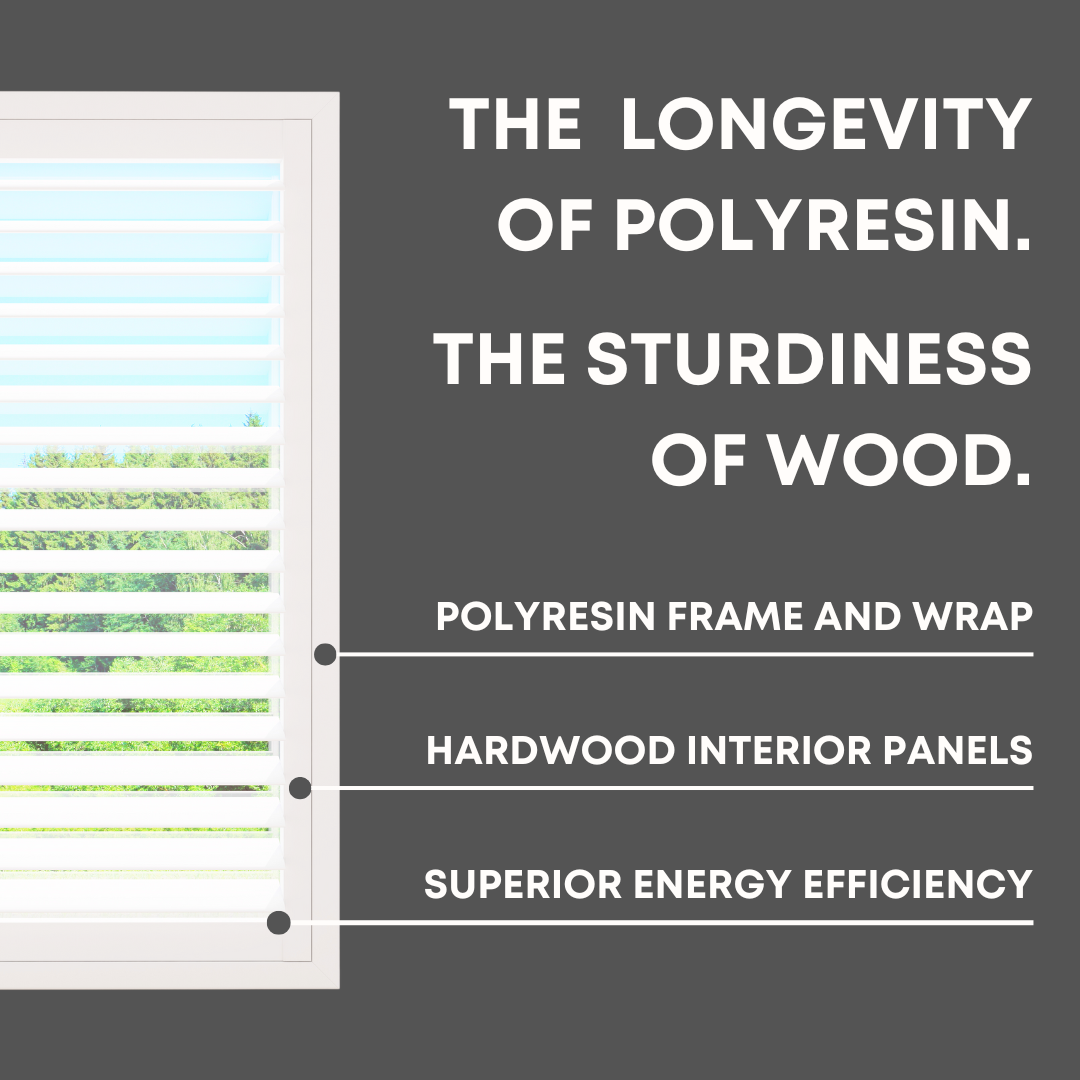

The federal government has introduced energy tax incentives and the Hybrid Wood Shutter qualifies.

This allows you to claim 30% of the buying price as a tax credit, with an annual ceiling of $1,200.

The Hybrid Wood Plantation Shutter is designed to provide superior insulation at the window, helping to lower your monthly utility bills.

Hybrid Wood Plantation Shutter

Begin designing your energy efficient plantation shutters by clicking the button below.

Estimated Ship Date:

-

Estimated Ship Date:

-

How It Works

-

1. Purchase Coverly Shutters

Purchase our qualifying Hybrid Wood Plantation Shutters. We will email the Certificate Statement after fulfillment.

-

2. Save Your Receipt

Save your receipt/proof of payment for your shutters (any third-party measurement or installation costs do not qualify).

-

3. Receive Certificate Statement

Print out the Manufacturer's Certificate Statement we send you to give to your tax professional when it is time to file your taxes.